Every B2B company needs to generate leads (unless you’re selling AI chips). And in our damp economic climate leads must be generated cost-efficiently. Smart marketers know the ROI of each of their marketing channels and allocate their budget accordingly.

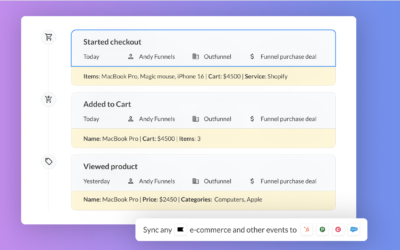

We at Outfunnel are no different, so we’ve invested quite a bit into capturing lead sources and auto-generating related reports. It’s a must if you want to know where your leads are coming from aka doing marketing attribution, especially if most of your leads are generated inbound, not outbound.

We’ve previously shared a blog post about our lead sources. Overall, we’re happy with how we’ve defined our lead sources and with how we’re able to “triangulate” data points to see how the effectiveness of our marketing mix is changing.

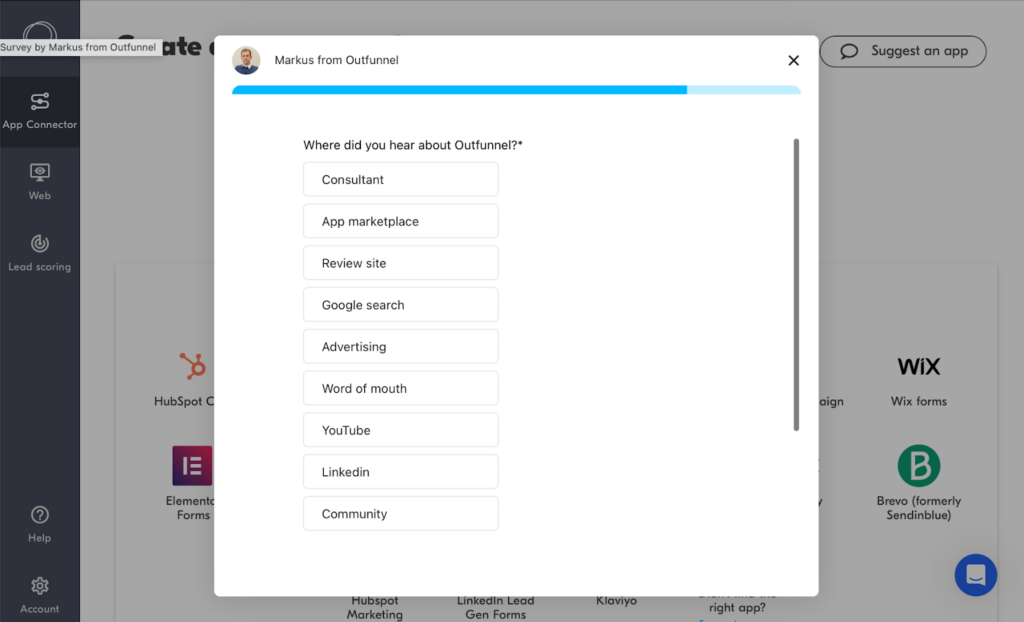

But we were wondering whether we’re still losing some of the nuances of tracking lead sources, so about a year ago, we started asking, “How did you hear about us?” in the signup flow.

I recently analyzed this self-reported attribution (or SRA) data, and here are our findings.

More than half of new signups share how they’ve found us

Filling the lead source field is not mandatory, and 52% of users fill this in, on average.

We use a single-select field as the self-reported attribution question but for a brief period, this was a freetext field.

As a side note, my favorite answer from that period was: “on a computer” 🙂

But most responses were luckily notably more useful.

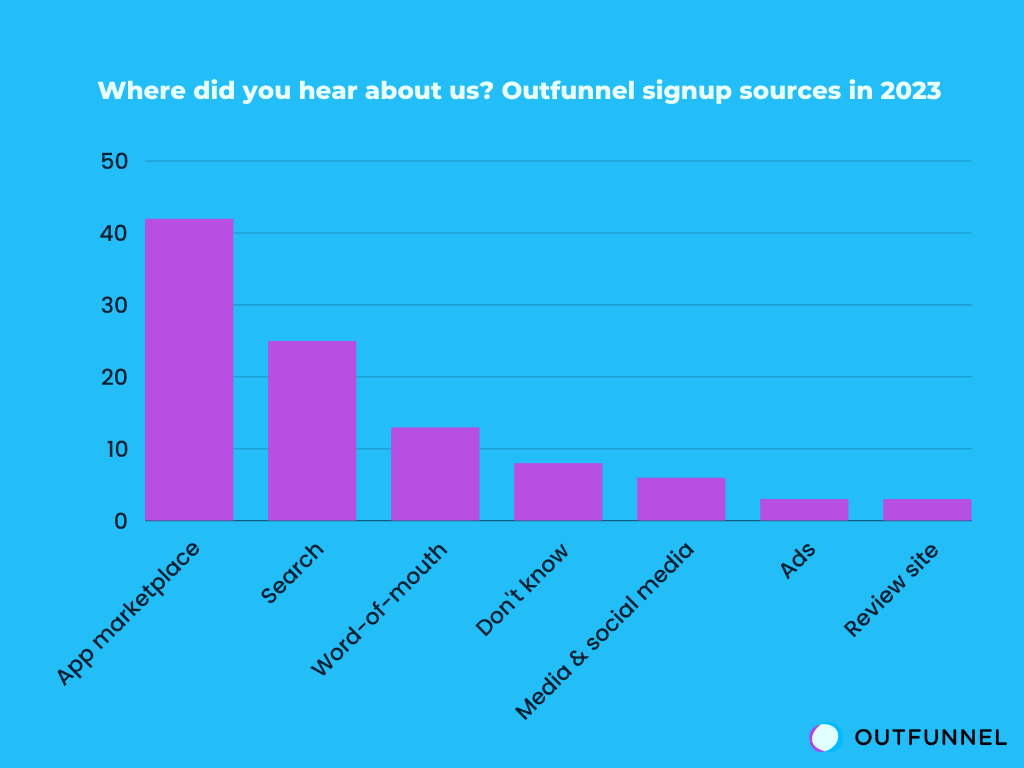

As you can see, app marketplaces such as HubSpot App Marketplace or Pipedrive App Marketplace are our biggest self-reported lead source, closely followed by search and word-of-mouth.

Note that media and social media sites like Linkedin and YouTube drive 6,6% of new signups and advertising 2,5%. For products like Outfunnel, where category awareness is high, brand marketing budgets are small, and the mode of purchase is self-service, the main way to discover products is by searching online and asking for recommendations. This is why our strategy of having a great product and being “findable” on Google and app marketplaces seems to work.

If we were selling a product with lower category awareness, a bigger marketing budget, and/or a more sales-driven discovery process, we could expect the share of media, social media, ads, and sales emails/calls to be significantly higher.

(I’ve written more about the importance of category awareness in picking marketing channels here)

Things we learned from comparing self-reported and captured lead sources

One of the aims for analyzing self-reported attribution was to see how similar or different the results are compared to the source/medium data we capture automatically.

To do that, we needed to reclassify some sources. For example, we know that roughly 2/3 of signups coming from organic search were searching for a brand term such as “outfunnel” or “outfunnel pricing” and 1/3 were using a non-brand term such as “hubspot klaviyo integration”. We thus reclassified the signups self-reporting as coming from search accordingly to match the captured sources.

We classified signups self-reporting to come from “word-of-mouth” to match the captured source “direct”. I also added signups that were not sure how they had heard about Outfunnel to that bucket.

I also left out about 3% of signups that self-reported coming from “other” sources because I simply didn’t know how to classify them :).

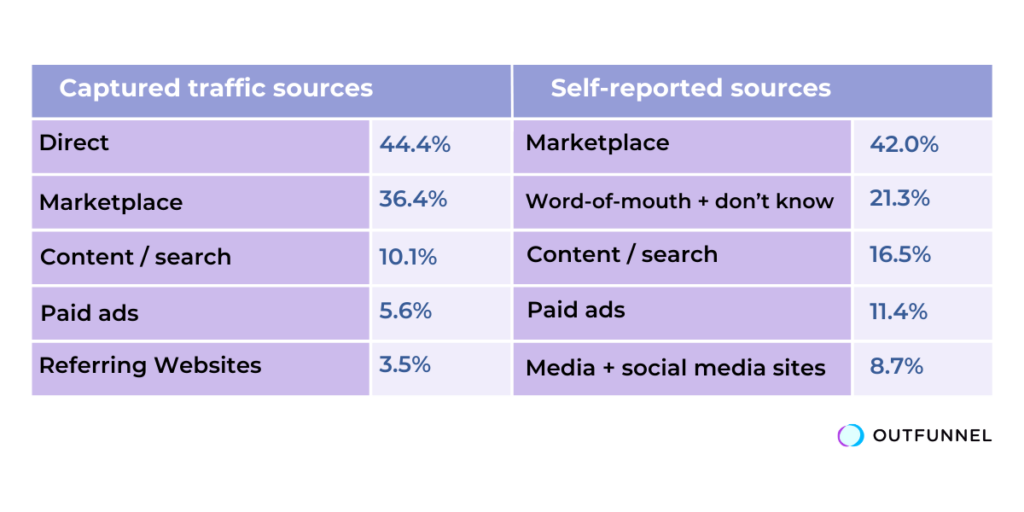

The result was this table:

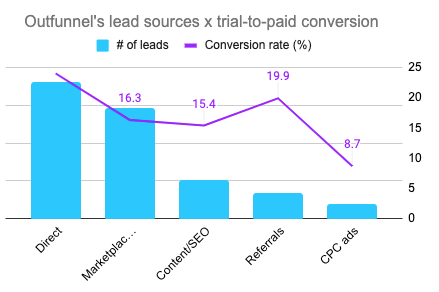

Our advertising ROI may be up to 2x better than we thought

Marketplace channel shows up remarkably similarly in both of our lead source data sets.

Advertising appears twice the size in self-reported attribution. One of the conclusions for this is that some people discover us via paid ads but sign up in a way that loses tracking codes (for example, researching on a phone and signing up on their computer), so our real cost-per-acquisition (CPA) from ads is lower than it seems based on captured source data. Perhaps not by 2x but even a 25-50% difference can make a big difference in ROI calculations.

Content/search shows approx. 1,6x bigger in the self-reported source data set, and I’m guessing for similar reasons than advertising.

The other reason for the big difference is the fact that the species that responds to the “how did you hear about us” question (humans) is known to make mistakes both when remembering and responding.

Referring sites similarly show twice bigger as the self-reported source, and there the difference may be explained by the above as well as the fact that not all mentions are hyperlinked.

Finally, the self-reported bucket of “word-of-mouth”+ “don’t remember” is roughly 2X smaller than signups that are classified as “direct”. This makes sense because we know that all channels contribute to “direct” and all channels lose some trackable source attribution for various reasons (multiple browsers, privacy features of browsers, etc.).

All in all, while there are some big differences between the self-reported and captured traffic source data sets, there are no unexplainable conflicts between the data sets. Both ways of capturing traffic sources are useful, and they’re most useful when they’re combined.

My 5 attribution conclusions and recommendations

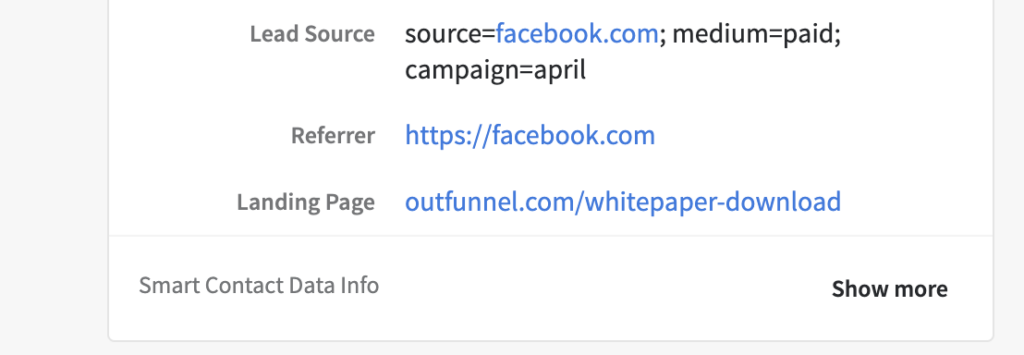

#1. Capture all source data at the time of capturing (web) leads

If you’re capturing leads on your website via web forms, chat, or meeting bookings, you’ll want to capture source/medium data, any UTM codes, referrer, and landing page data.

Major CMS + marketing automation platforms like HubSpot have this functionality built-in.

If you’re using WordPress to run your site and added tools like Gravity Forms, Calendly, or Intercom to it you’ll need to add a tool or plugin to capture that data. Outfunnel can auto-capture lead sources for you, I’ve also heard good things about Attribution for this.

#2. Ask “how did you hear about us”

You’ll also want to hear the discovery journey from leads and customers directly, either continuously or at regular intervals.

If you have a low volume of leads and a sales-driven go-to-market, have your salespeople ask it and record the results in your CRM.

If leads are generated online, start with a freeform text and switch this out to a single- or multiple-choice question later.

Please note that if you have a large volume of leads, you can do this for a certain % of new leads only. This way you’re not unnecessarily slowing down everyone that enters your funnel.

#3. Compare captured lead source to self-reported lead source to “complete the picture”

Only capturing the lead source data or asking the “how did you hear about us” is a solid start. But in both cases, you’ll have some unanswered questions. For example, if multiple lead sources are playing their part, what’s the most important one?

Doing both and comparing the results as we’ve described above gives you near-perfect visibility into what channels and campaigns are generating the best leads.

#4. Look at trends over time

Unsurprisingly, things are always changing.

It’s not enough to do this analysis once, you’ll want to keep an eye on changes all the time.

Below is a graph from our signup sources by month. I’m always happy to compare notes with fellow marketers, but I don’t want to overshare, so I’ve left out the legend but you’ll get the gist.

#5. Adjust your channel mix and budgets according to attribution analysis

As you begin your lead source attribution journey, you’ll surely encounter some surprises.

For example, a Facebook campaign that’s driving a ton of traffic and leads has very low conversion to paid.

Or perhaps a landing page with a low volume of incoming leads generates deals that are 3x bigger than most other campaigns.

In our case, I was surprised to learn that paid ads play a more important role in our lead generation than source and UTM data alone would lead me to believe. I can relax my ROI thresholds in the future.

PS. This post was all about sharing our experiences and recommendations on the topic. But it’s also a piece of content marketing. If you’re reading this and think you could use a better method for capturing lead sources, maybe give Outfunnel a go?

(And if you do this, don’t forget to smile when you get to the “how did you hear about us” question).