Last year, we analyzed which marketing automation tools paying Outfunnel customers use with different CRMs. That dataset reflected long-term decisions: tools teams had already committed to and built processes around.

This time, we looked earlier in the journey. Instead of paid customers, we analyzed (thousands of) our free trials from 2025.

Trial behavior is noisier than paid usage, but it has one important advantage. It captures intent before habits, contracts, and organizational constraints settle in. It shows what teams want to do, even if they do not all end up doing it long-term.

There are a few important caveats.

First, this analysis includes only trials where a CRM was connected. Outfunnel trials can also involve non-CRM setups, such as syncing Mailchimp with Google Sheets or connecting Airtable to Klaviyo. Those use cases are valid, but they are not what this post is about. What we are looking at here is a specific slice of the market: teams that already care about how sales and marketing data should flow through a CRM.

Second, our integrations cover a relatively small part of the martech landscape, and our ability to stand out among users of different sales and marketing tools varies.

So we’re looking through a narrow keyhole — but a useful one.

Facebook Lead Forms show up surprisingly high in B2B stacks

One of the more surprising findings in the data is how often Facebook Lead Forms CRM connection appear in our trial setups. Across all CRM-connected trials, it was the single most connected app at 19.2 %, ahead of marketing automation leaders like Mailchimp and Klaviyo.

This shouldn’t be dismissed as an anomaly. Industry research shows that more than half of B2B marketers use Facebook for paid advertising, and a large majority of B2B buyers research solutions on Facebook, suggesting that the platform plays a meaningful role in professional demand generation despite its consumer associations.

Part of Facebook’s appeal is also economic: benchmarks often show lower cost-per-lead on Facebook compared with LinkedIn, even though the platforms can differ in lead quality and downstream conversion.

| Apps connected to CRM trials (2025 Outfunnel data) | |

|---|---|

| Facebook Lead Forms | 19.2% |

| Mailchimp | 18.2% |

| Klaviyo | 16.4% |

| Calendly | 14.7% |

| Web visitor tracking (Outfunnel native feature) | 12.7% |

| Google Sheets | 8.5% |

| Brevo | 6.8% |

| LinkedIn Lead Forms | 6.5% |

| Meta Custom Audiences | 4.5% |

| ActiveCampaign | 4.4% |

Part of Facebook’s appeal is also economic: benchmarks often show lower cost-per-lead on Facebook compared with LinkedIn, even though the platforms can differ in lead quality and downstream conversion.

In other words, while LinkedIn remains a top channel for many B2B teams, Facebook is far from irrelevant — and trial behavior shows that fast, lower-friction capture via Facebook Lead Forms fits into many sales-led stacks.

B2B marketing automation leaders: Mailchimp and Klaviyo win for different reasons

Mailchimp is the “IBM of email marketing”, it tends to win when teams want something familiar and broadly applicable. It shows up consistently in trial data and continues to function as the default option for many teams.

That has not changed.

What has changed is where Mailchimp is no longer the clear leader.

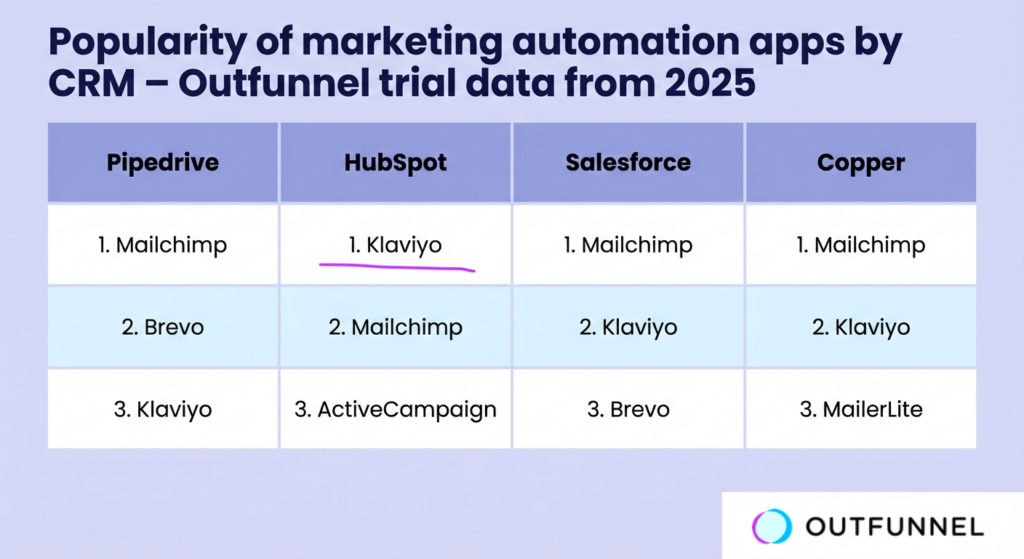

When we look at marketing tool popularity by CRM, different ecosystems behave differently. In case of Pipedrive, Copper, and Salesforce Mailchimp remains the most commonly connected marketing automation tool, followed by Klaviyo, Brevo, and MailerLite.

HubSpot is the exception.

In HubSpot trials, Klaviyo is the most commonly connected marketing automation tool, ahead of Mailchimp and ActiveCampaign. This mirrors what we saw in last year’s analysis of paying customers. It’s a powerful tool for setting up complex email journeys, especially in ecommerce context.

Because HubSpot Marketing Hub already covers basic marketing workflows, teams may only connect an external tool when it offers clearly differentiated functionality. Anecdotally, we see a growing number of companies running B2B sales and ecommerce in parallel, which would explain the popularity of Klaviyo.

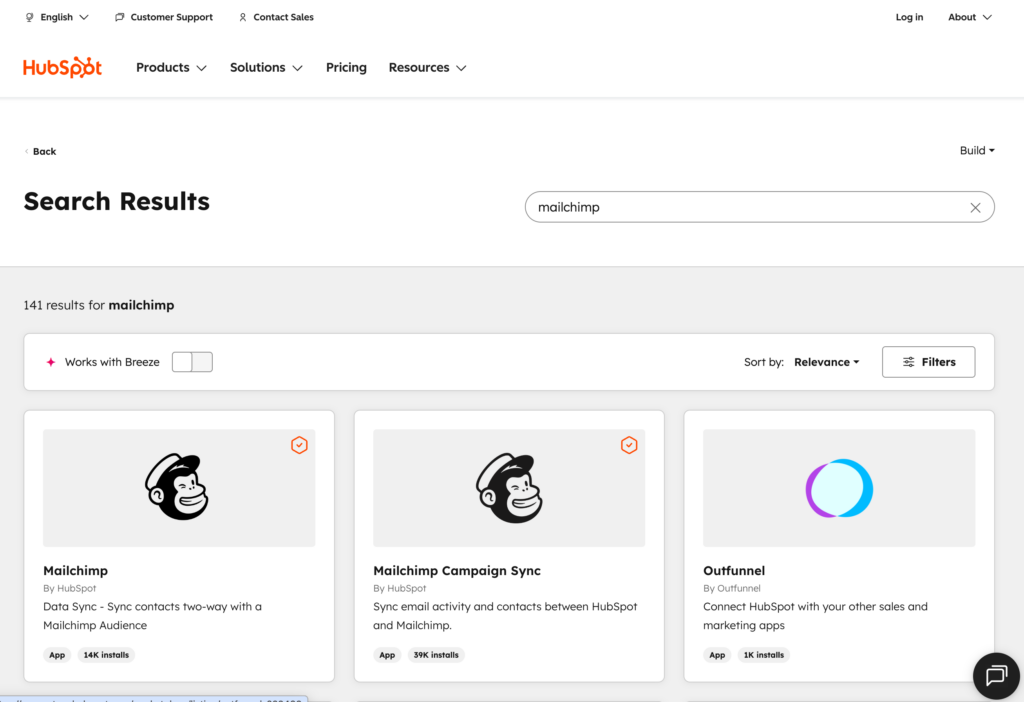

If every CRM has native integrations, why do third-party iPaaS tools still win?

Every CRM we looked at has a pretty good native Mailchimp integration (HubSpot has two). HubSpot also offers broad native marketing capabilities. So why do teams still use third-party integration tools like Outfunnel?

The simplest answer is that “native integration exists” is not the same thing as “native integration is good enough for how teams actually work.”

In practice, adoption is driven by questions like:

- Does it sync the right objects and fields?

- Does data move one-way or back-and-forth?

- Can I control timing and logic, or am I stuck with defaults?

- Does it support real workflows (segmentation, lifecycle states, lead sources, attribution) without hacks?

- Ultimately: can I implement the workflows my sales and marketing teams need?

This also helps explain why “all-in-one” platforms like HubSpot and Salesforce have rich third-party ecosystems. Checklists matter less than how well tools work together in practice.

Trial users vs paid users: intent vs commitment

Trial data and paid customer data answer different questions.

Trial users show curiosity. Paying users show commitment.

Some tools are easy to try but hard to operationalize. Others may not dominate trials but become deeply embedded once workflows mature. The gap between trial behavior and paid usage is not a flaw in the data. It reflects the difference between experimentation and long-term adoption.

Trial data should not be treated as a verdict. It is a directional signal.

CRM choice correlates strongly with the rest of the stack

When we look at which tools are connected alongside different CRMs, a clear pattern emerges: CRM choice is not neutral. It correlates closely with the broader sales and marketing stack teams assemble during evaluation.

For example, when we rank the most popular lead form and database tools across CRM-connected trials, the differences are striking:

| Popularity of lead form and other apps by CRM – Outfunnel trial data from 2025 | ||

|---|---|---|

| Pipedrive | HubSpot | Copper |

| 1. Facebook Lead Forms | 1. LinkedIn Lead Forms | 1. Facebook Lead Forms |

| 2. Calendly | 2. Google Sheets | 2. Gravity Forms |

| 3. Google Sheets | 3. Calendly | 3. Calendly |

Naturally, our “keyhole” is impacted by the amount and quality of alternative integration options but the data is still telling.

These patterns align with what broader industry research tells us about CRM and persona clusters. For instance, Gartner and Forrester research consistently profiles Pipedrive as a choice for sales-led SMB teams who prioritize straightforward lead capture and pipeline visibility. This maps well to the prominence of paid social and lightweight form tools in its ecosystem. Conversely, HubSpot CRM often attracts marketing-oriented teams working with richer data and professional networks, which helps explain the higher relative popularity of LinkedIn Lead Forms and Google Sheets as integration points.

It is difficult to draw a clean line between cause and effect in these correlations. Some teams choose a CRM first because it fits a particular go-to-market model, then build the rest of the stack around it. Others arrive with marketing tools already in place and choose the CRM that fits best with those investments.

What is clear is that CRMs are not neutral infrastructure. They shape ecosystems. Even at the trial stage, the choice of CRM coincides with distinct patterns of complementary tooling, and those patterns reflect real differences in how teams approach lead capture, data flow, and cross-functional alignment.

So, what does this mean for my team?

The first thing to acknowledge is that this data does not represent the entire market. Outfunnel sees a specific slice of it: teams that care about how CRM data and marketing tools work together in real workflows.

The second takeaway: make conscious choices about your tools and integrations. Early setup decisions tend to reflect how your team actually wants sales and marketing to work together.

If your current tools are not giving you the workflows you need, that is usually not a limitation you have to accept. In many cases, there is a better way to connect your CRM and marketing tools so the data flows the way your team expects it to.

And we at Outfunnel offer pretty good integrations for Pipedrive, HubSpot, Copper, Salesforce, Airtable, and Monday, so you know.